When you are purchasing items, it can be difficult to decide when to expense it and claim the full cost in the current year or to capitalize the item.

One of the first things to consider is what is the life expectancy of the item. Items expected to last longer than one year are capitalized, whereas costs with short-lived benefits, for example less than a year, are claimed in the current year.

An item that is expensed is included in your income and expense statement. This claims the whole cost of the item against your income in the current year.

An item that is capitalized is seen on the balance sheet. The item is entered at the purchase cost, less GST/HST, and then a portion of the item is claimed each year.

Another factor to look at is the cost. If you are working with an accountant or tax preparer, you may want to have the discussion with them as to their individual policies. The traditional thought was if it was more than $250 you would capitalize the item. This may change depending on your individual operation and your tax advisor.

If you are doing repairs on equipment or buildings, you may need to again review if the costs are expenses or if they should be capitalized. Generally, if you are increasing the value or can extend the useful life of an asset then you would capitalize the item.

Here are some examples to illustrate the concept:

You purchase a chainsaw that has a useful life of five years, but your farm has set a capitalization limit of $1,000. Because the cost of the chainsaw was $950, you would expense the item and claim the full cost of the chainsaw in the current year.

You build an addition to the barn and there is the cost of building materials, equipment and wiring. These items would be capitalized but into different classes.

It may seem tedious to take the extra steps to enter your capital assets properly, but you will appreciate the extra step later when you are doing your year end and your accountant has to do adjusting entries to reallocate all of these expenses.

This step is also advantageous for when you sell that capital asset. If it is entered properly in the software, your accountant will have all the details required to calculate the gain or loss on the sale of the item.

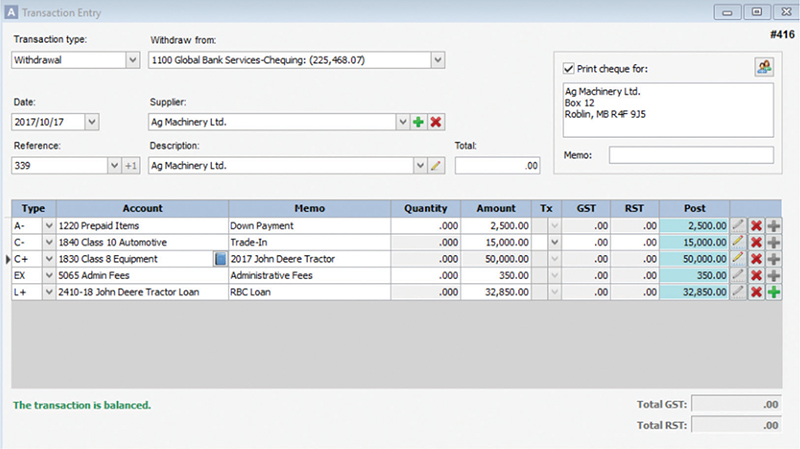

You may have experienced that discussion when you trade in one piece of equipment to purchase another, and you are asked for the original purchase documents. It can save a whole lot of grief if you have entered the item and it is listed in your list of assets and can be removed or used to claim the CCA/depreciation on that item.

Being able to print one report that shows your capital asset purchases and sales at the click of a button will be well received by both you and your tax preparer.

If you are going to capitalize, it is worth the time to know what class to put the asset into.

Some of the usual classes are:

- Class 1 (4%) buildings (acquired after 1987), barn, or building materials used to build a barn

- Class 6 (10%) feed bins, grain bins, fences, greenhouses, irrigation ponds

- Class 8 (20%) equipment and machinery that are not self propelled (ie. gravity wagons, heating units, cultivator, milk coolers, gps systems, baler, load for a tractor, combine heads). Tile drainage may also be placed into this class.

- Class 9 (25%) drones

- Class 10 (30%) equipment and machinery that are self propelled (ie. tractors, combines, vehicles)

- Class 10.1 (30%) passenger vehicles costing more than $30,000

- Class 16 (40%) trucks (freight)

- Class 17 (8%) roads or other surfaces

- Class 50 (55%) computer equipment and software systems