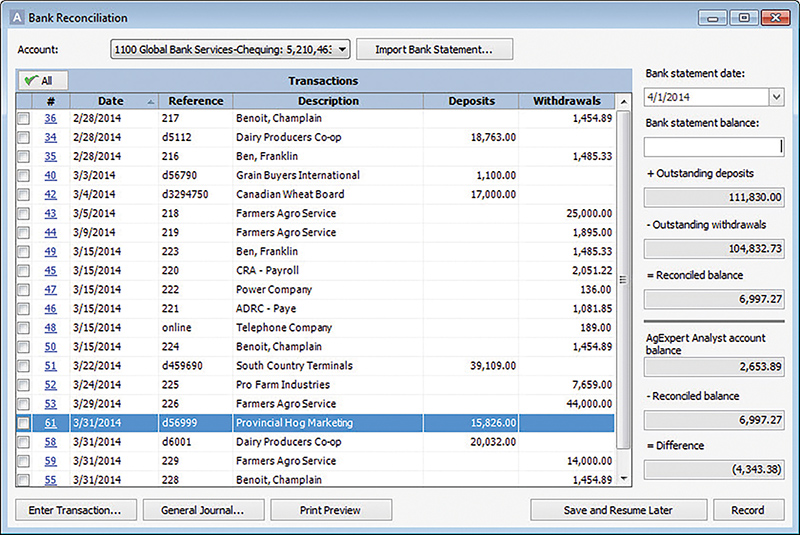

Opening the reconciliation tool will allow you to enter the ending balance of your bank statement and check off the transactions that have cleared the bank. This will leave you to resolve any discrepancies. Courtesy Photo

Before you make the claim that a bank reconciliation is not important, do you understand what a bank reconciliation is and why it is important to your business or even your personal accounts?

A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement. The goal of the bank reconciliation process is to find out if there are any differences between the two cash balances. If there are any discrepancies, you have to check your company’s accounting records.

It is important to do regular reconciliations on not only your bank account but also on credit cards, loan accounts and prepaid accounts.

In our hectic world, it can be easy to forget about a cheque that was written and not cashed, or a loan payment that has been scheduled to be paid.

Just looking at your balance in your bank account does not provide you with a true representation of the cash available to you, especially if you have transactions that have not cleared your account.

Performing a bank reconciliation monthly is the preferred method. At the least, reconcile the bank account each quarter when you file your GST/HST return. This will ensure the accuracy of your records but also your true position when filing your GST/HST return.

Compare your books to the statements

Checking the transactions on your statements to and comparing them to your books and records is a matching process. Verify, that the transactions on your statement are recorded accurately in your records.

Loans can be an important part as well. If you have a loan for a construction project or for crop inputs, it is becoming more popular that those specific companies may be presenting their invoices directly to your lender and the lender is paying these invoices. This is easier to track if you do it on a regular basis, rather than having a surprise at the end of the year by having balances you were not prepared for.

You may not realize that these providers have been submitting invoices for payments and therefore, there may be errors or variances on those charges from what you were expecting or had approved.

The information on the statement is the bank’s record of what has gone into or out of your account. The information in your books and records are what you have entered; therefor you want to ensure that the unrecorded transactions are in your records, so you know what your true available cash or shortfall is.

Going through each transaction individually may sound tedious, but it is the best way to ensure your records are accurate and that there are no unknown or fraudulent transactions on your accounts. You want to make financial decisions based on your true financial position.

AgExpert allows you to reconcile the transactions in your software program, to the transactions that have happened in your bank account. By opening the reconciliation tool, you will enter the ending balance on your bank statement and then proceed to check off each of the corresponding transactions. Once you have completed that process, you will be left with the transactions that have not cleared the bank, or that you had not entered into your records.

You may pay vendors and creditors by issuing check payments. When a check is issued, your bank statement won’t reflect the outstanding checks if they haven’t been cashed yet. On the flipside, your bank statement may not show deposits if they’re still being processed by the bank.

You may also have your credit card on file at various providers and those payments will be automatically withdrawn from your account.

Transactions that aren’t accounted for in your bank statement won’t be as obvious as bank-only transactions. This is where your accounting software can really help you reconcile and keep track of outstanding checks and deposits. The reconciliation module allows you to check off outstanding checks and deposits listed on the bank statement.

Now you should have adjusted balances from your bank and your accounting records, to compare to one another.

Once you have reviewed your books and records and compared them to your statements, you may find there is still a discrepancy. There are many possible reasons for this.

Transposition error

This is a simple data-entry error that occurs when two digits are accidentally reversed (i.e. transposed) when posting a transaction. For example, you wrote a check for $32, but you recorded it as $23 in your accounting software. You can avoid these errors by printing checks directly from your accounting system.

This may also happen if the bank clears a cheque for a different amount than what it was originally written for. You may have to post a transaction for bank fees to account for the difference, but it is always a good practice to verify why there was a difference.

Forgetting to record a transaction

Checking to ensure income and expense transactions have been entered into your records correctly ensures you claim your income and expenses accurately. If a transaction has not been recorded or the regular monthly amount has changed, correcting the entry will bring your account into line.

The beginning cash balance is incorrect

If your beginning balance in your accounting software isn’t correct, the bank account won’t reconcile. This can happen if you’re reconciling an account for the first time, or it wasn’t properly reconciled the month before. You may need to go back to previous months to locate the discrepancy.