Determining the need to hire employees can be exciting; although the thought of having to prepare payroll on a regular basis and submitting deductions at source, can be overwhelming.

The thought of having others to help you reach your goals and allow you to have some quality time as well comes with those conversations of; do I pay them under the table, barter system, or bite the bullet and hire them?

Hiring them, and taking the required deductions is in your best interest.

The discussions around how difficult it is to prepare payroll, and all the hoops to ensure you are calculating accurately, can be a fear factor for sure.

With accounting software, a lot of that fear is taken away, it does all the hard work for you.

To start with your payroll, contact the Canada Revenue Agency (CRA) and have them add a payroll account to your business number. This number will be the same as your sales tax number (HST) but will end in RP instead of RT.

Registering for a payroll number is not difficult. Be prepared to answer how often you will be paying the employee, how much you expect to pay your employee over the year, when you expect the employee to start, and you will be up and running.

Important information you will want to have prior to setting up that first employee; the employee’s name, address, date of birth, social insurance number, their start date, rate of pay (hourly or salaried) and are they arms length or non arms length.

Setting up for payroll accurately will start you off on the right foot. Have your employee complete a TD1 form. This provides you with all the information you require to set up your employee. This form provides you with the basic information including their social insurance number (SIN). Why is this important? You will require their SIN to issue the T4 at the end of the year. Without the SIN, you will be subject to fees from Canada Revenue Agency.

You will also know their age. This will assist in the deductions that should be taken off. If you are hiring a student, you will not deduct Canada Pension Plan (CPP) until the month after they turn 18.

Choose how often you wish to pay the employee, so they know when to expect to be paid, and you can prepare the pays on time. You may choose weekly, biweekly, semi-monthly, or monthly.

The hire date is important; if you must issue a Record of employment, this will be required to calculate the document.

Once you have entered the information into your program, you are ready to prepare your first pay cheque.

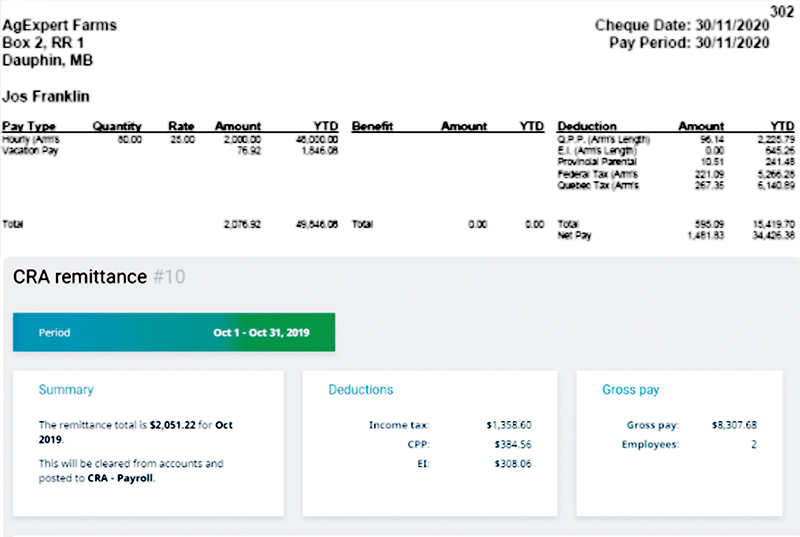

Enter the date of the paycheque, rate of pay and the program will provide you with the information you need. By entering the information there are many things going on behind the scenes. This includes the deductions that are taken from the employee for the income tax, CPP and Employment Insurance (EI). You will have a paystub to provide the employee, so they know how the information was calculated. When you pay each employee, you will provide them with a copy of their paystub.

The calculation for the amount of CPP and EI that you owe on their behalf is calculated. These deductions at source are due to the CRA by the 15th of the following month. Depending on your financial institution you may need to file this information at least a day or two before the required date. Making these payments through your online banking is simplified through the Pay business taxes on your pay bills tab.

The end of the year process is being calculated as you progress through the year. Every time you prepare a paycheque and remit a deduction at source, the software is calculating and tracking the information required to provide the T4 to your employee at the end of the year plus the calculation of the T4 summary required by CRA.

T4’s are due by Feb. 28 of each year. These can be mailed to CRA or filed online through the accounting programs as well.

The saying, “many hands make light work” is true here. Embrace the opportunity to hire and have the software make your job and compliance less daunting.