A successful business has many moving parts. Part of that is remaining compliant with the Harmonized Sales Tax (HST) filings.

As a business owner there are some options available and then there are the mandatory segments.

Do I need to register?

If your sales are under $30,000 you are not required to register. This does not mean it is in your best interest not to register. In ag business there are many reasons you may want to register regardless of the sales amount. If you are producing a zero rated product, you may want to still register to recuperate the taxes you have paid out on supplies and utilities.

What is the difference between zero rated and exempt tax?

Zero rated items are goods and services that are basically taxable, but the legislator decided to rate it at a “0” rate. This includes dairy, livestock (some exemptions), and crops (some exemptions). It is important to check on the actual status of the product you are selling before you start to sell. For example, selling hay to a dairy or goat farmer, the product is zero rated, but, if you are selling to a horse farm the hay is taxable.

Exempt from tax is a good or service that is not taxable. An example of this would be a grant.

Zero rated sales are included in your sales line on your HST filings. Exempt rated sales are not included in the sales’ line.

If you are adding services or products to your farm business, make sure you verify how the additional products are rated for HST.

If you are renting land out and are registered for HST, this is a taxable transaction.

HST is collected on livestock not sold for human consumption.

HST must be charged on zero-rated farm equipment when it is rented or leased.

Choosing your filing period

Many farms choose to file annually. Some look at this as they only need to keep their books up to date once a year to make the filing. One thing to consider is on those years when you have a lot of purchases with HST or if you are under construction, you may find this annual filing option has a very negative impact on your cash flow. Having to wait months for your HST refund can cause a shortage of cashflow and potentially slow down your progression.

What is required on your documents?

Documentation required for receipts is dependent on the value of the sale. Sales under $100 require the name of the supplier, date of invoice or date paid, and total amount of the invoice. For sales between $100 to $499.99 require the previous information plus the amount of tax charged, and a valid suppliers’ HST number. For those sales over $500, all the previous information plus the purchaser’s name, description of property or service and the terms of payment. If you have a corporation, or a business operating name, it is important to have receipts issued to the corporation’s name or your business operating name.

The Canada Revenue Agency (CRA), can deny any claims for HST if the information is not accurate.

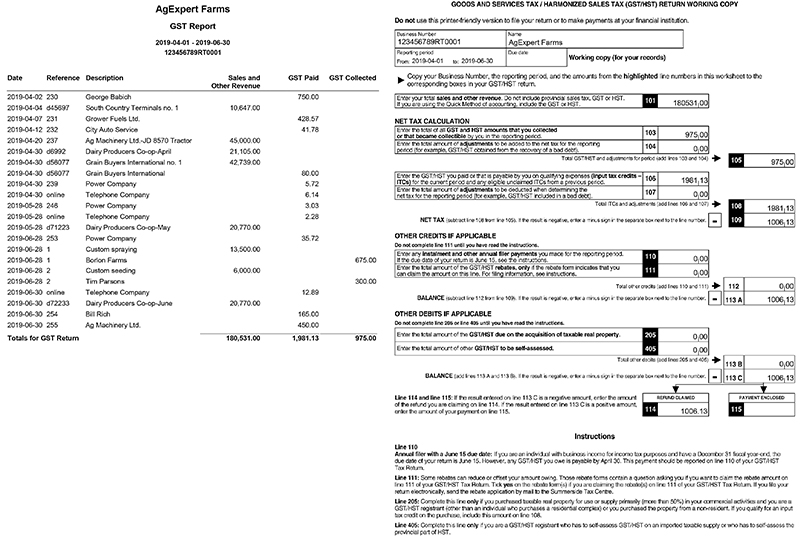

Accounting software can increase your supporting documents if you do find yourself having to provide supporting information to the CRA. At the end of each reporting period ensure that you print out your HST report to show what was included in the applicable lines. An inclusive report would include the sales, any HST collected and a listing of the HST paid.

Having the security of backup documents allows you to file your reports, claim your allowable input tax credits (ITC) and not having to worry about if the CRA does ask for supporting information. Reports are easily produced.

Knowing what is required when making your HST claim will reduce the concern when you are contacted by CRA to provide the documents. You will have the assurance that your records match what was filed and you are able to produce substantial supporting documents and reduce the possibility of a full audit.