Revewing accounts

Reviewing your accounts payable as part of your year-end process is a good policy. Knowing what is outstanding and affecting your next year’s cash flow. Courtesy Photo

Knowing how much money is in the bank will assist with cashflow but that does not show you your whole financial picture.

As farmers, you can keep your financial records on a cash basis for government filing purposes but your reporting requirements to your financial institution may require you to also keep track of the accruals (accounts payable, accounts receivable and inventory).

Accrual accounting makes the relationship between income and expenses clearer, providing a better picture of profit or loss. This also provides a business with a better understanding of its assets and liabilities.

Accruals are important because they keep track of the financial position more accurately and systematically.

Cash is a more simplified system to maintain. Keeping track of what goes in and out of your bank account seems a little less daunting. Cashflow is key in this scenario.

Cash accounting can be misleading because it may show that you are profitable when you have outstanding bills. It is unhelpful when it comes to making business decisions if you do not have the complete scenario of outstanding income and expenses.

Cash accounting does have advantages when it comes to the tax side of your business. When filing a tax return on a cash basis, you can ultimately control the bottom line by what goes in and out of your bank account. You can show you have less income by claiming expenses paid that may not be relevant to that current period but on the reverse, you can claim higher income by having outstanding invoices that are not accounted for.

Why accrual accounting is more beneficial than cash accounting?

Accrual accounting gives you a better indication of the business performance because it shows when income and expenses have occurred. If you want to see if a specific period was profitable, accrual will tell you that.

It is important in your accounting software that if you enter your accounts payable and receivables, be sure that when you make a payment to apply those payments against the accounts payable already set up in the system. It can be very easy to just enter a cheque and pay an invoice without applying it against the accounts payable. This will cause several issues including over claiming expenses and possibly overclaiming HST.

Best practices are to enter your invoices and then to process a payment. This will help you to ensure you are not double billed for any supplies or services. This will also allow you to keep track of what is outstanding in your expenses.

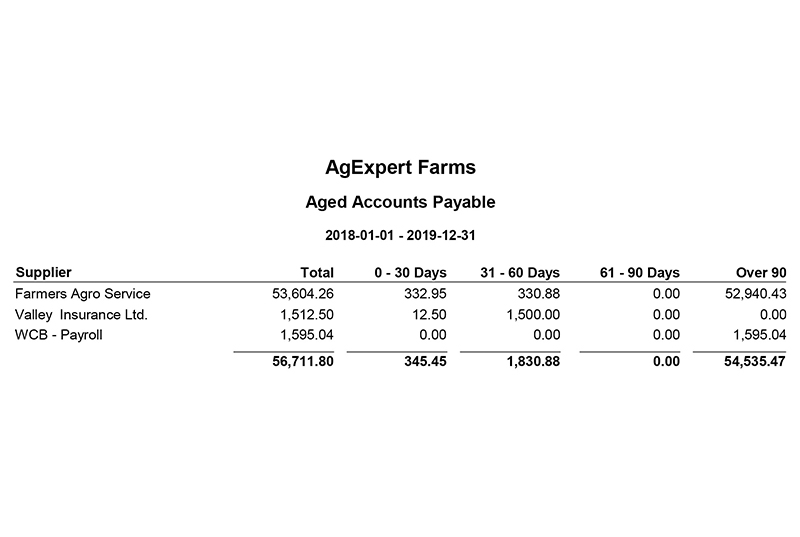

Review all outstanding items as part of your year-end process. The accounts payable aged report will help to review and confirm outstanding amounts owing.

With the capability in most software programs to allow you to print your reports in either accrual or cash if the entry is done appropriately, you will have the best of both worlds at the tip of your fingers.