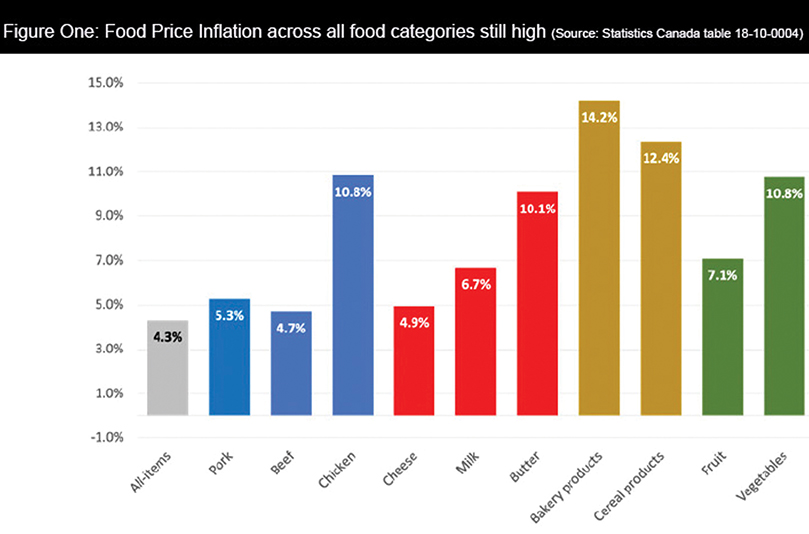

Figure 1: Food price inflation across all food categories still high. Source: Statistics Canada table 18-10-0004

By Terry Tinkess

AgriNews Staff Writer

In January, The Farm Credit Corporation (FCC) identified several items as influential factors that should be monitored in 2023. These factors are elevated input costs, butter stock levels, imports of dairy products, and retail price inflation.

1. Elevated input costs

According to the FCC, input costs have leveled off. They are not expected to decline, but they are not expected to increase further at the present.

Forecasts of feed costs for 2023 are unchanged since January, while new crop futures contracts for corn indicate relief may come towards the end of the year, but a weaker Canadian dollar will restrict how low corn prices can go this fall. Farms that can grow their feed can take advantage of this cost opportunity and do so at a lower cost.

The FCC also reports that fertilizer prices are down and are expected to fall further in 2023. Fertilizer, however, makes up a small portion of total costs for dairy producers. The Bank of Canada (BoC) seemed unlikely to change their overnight rate this year, but there are also rumblings that a further rate increase might be required to slow inflation further. In any case, interest costs should be monitored closely.

2. Butter stock levels

Butter stocks are still trending to be low during the year, maintaining the trend that was observed in 2022. Estimates are for butter stocks for December 2023 to be between 21,500 and 27,000 which, at the lower end of that estimate would put butter stocks as of December 2023 marginally higher than in December 2022.

3. Imports of dairy products

To this point in the dairy year, milk prices in the US have been strong. Except for butter, strong prices have limited the appeal of imported dairy products. In the first eight months of the dairy year, only two per cent of negotiated milk import volumes under the Canada-United States-Mexico Agreement (CUSMA) have been filled.

4. Retail price inflation

Dairy Producers Association of Canada (DPAC) data shows that, on a 12-month rolling period ending December 2022, demand for cheese, yogurt, and fluid milk is down (cheese is down -0.7%, yogurt is down-0.7%, and fluid milk is down -2.1 %). Demand was up marginally (+0.2%) for butter and steadily (+1.7%) for cream.

It is important to note that this data is reflective of the period before the butter support price took effect on Feb. 1. While increases in the butter support price does not translate into an equivalent and immediate increase in the retail price of dairy products, it does have an effect.

Statistics Canada’s inflation data for March, shows dairy product price inflation is comparable to other food categories. Amongst food categories, beef, cheese, and pork are among the lowest rates as of March. In the bakery products it is interesting to note that prices for dairy ingredients that go into commercial baking are based on US prices. (See figure 1, Source: Statistics Canada table 18-10-0004.)

Overall, the outlook for the dairy industry has changed little since January. Revenues have seen a small boost with greater butterfat production in the WMP and a shift in milk allocation to different classes, benefitting producers in the P5. Input costs, particularly feed costs, will remain elevated for 2023.

(Information contained in this article is based on the FCC 2023 Dairy Outlook Update. For further information on the Farm Credit Corporation, please visit their website at csc@fcc-fac.ca.)